|

|

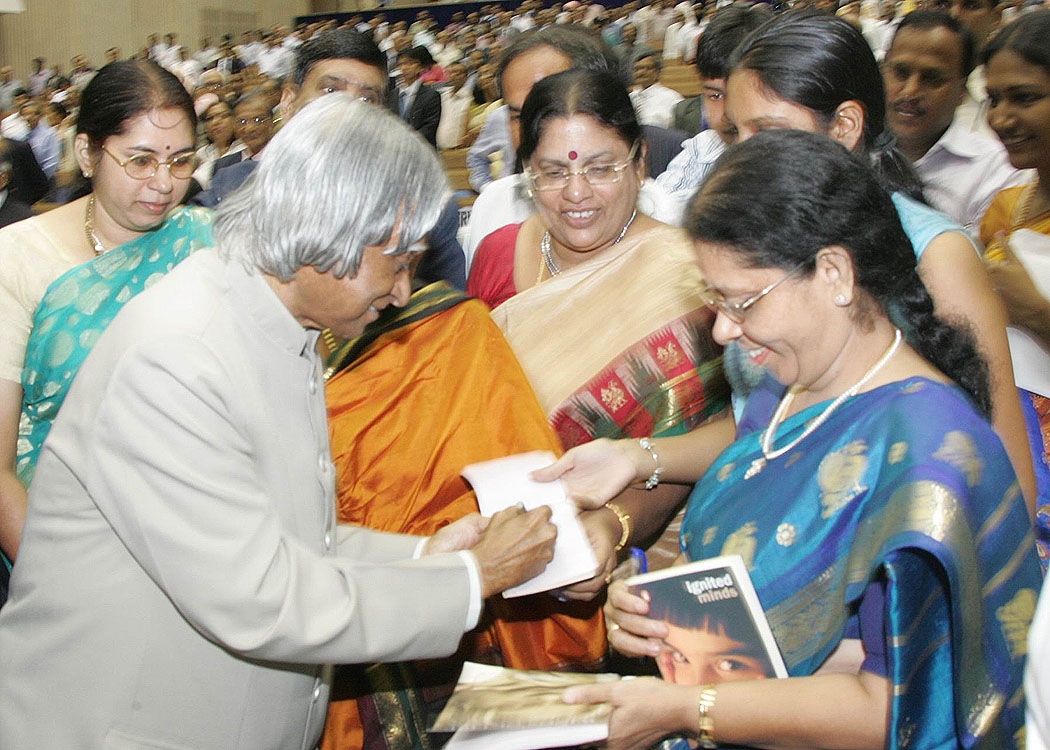

ADDRESS AT THE CENTENARY CELEBRATIONS OF BANK OF INDIA, NEW DELHI

25-08-2006 : New Delhi

Dynamics of Banking for Prosperity

"Small aim is a crime"

I am delighted to participate in the Centenary Celebrations of the Bank of India. Bank of India during the last hundred years has been a partner of the Government in every economic activity. I congratulate the Bank of India community both present and past who have built a robust institutional framework for Indian banking during the last hundred years. I extend my greetings to the organizers, senior bankers, economists, policy makers, academicians, government functionaries and all the bank employees, particularly young executives, who will carry the bank into the coming decades.

Mission for banking industry

What can be the mission of banking industry in our country? The nation is economically transforming and there are many indicators to show that our economy is in the ascent phase. The result of the economic ascent has to get reflected in the 600,000 villages where 70% of our people live, that is 700 million people. This covers over 200,000 Panchayat?s. How to bring the prosperity to our rural economy is indeed a big challenge, it has to be the mission of the banking industry. I am glad to know that the Bank of India has over 2600 branches throughout the country and also with a number of branches abroad. In terms of business, the bank has emerged as the third or fourth largest nationalized bank in the country. I extend my greetings to all the team members of Bank of India within the country and abroad on this great occasion of the Centenary Celebrations.

What can be the role of this Bank up to year 2020? That is for the next 14 years. Fourteen years is very significant for Indians. In fourteen years, epically a glorious transformation took place. I am sure Bank of India will become a partner in the mission of making a great difference to the economy of the nation in this period. How it can be done? Fortunately, you have a road map. To reinforce the roadmap, I would like to share with you a few thoughts on "Dynamics of Banking Industry".

Our National Mission - Challenges

For transforming India into a developed nation and bring prosperity to all the one billion plus people, we have identified five areas where India has core competencies for integrated action: (1) Agriculture and food processing (2) Education and Healthcare (3) Information and Communication Technology (4) Infrastructure for all parts of the country, reliable and quality energy, surface and air transport and (5) Self-reliance in Strategic sectors. These five areas are closely inter-related and when effectively addressed, would lead to food, economic, energy and national security and would lead to sustainable prosperity. These are the tools to carry out the mission.

Bharat Nirman Programme

Bharat Nirman is a time-bound plan for providing basic infrastructure in our rural areas with an allocation of Rs. 1,74,000 crores for the duration of four years. This programme of my Government will seek to:

- Provide electricity connection to every village in the country;

- Provide an all-weather road to every habitation of over 1000 population and above, or 500 in hilly and tribal areas;

- Provide every habitation a safe source of drinking water;

- Provide every village a telephone connection;

- Create 1 crore hectares of additional irrigation capacity;

- Construct 60 lakh houses for the rural poor.

Building on the on-going schemes and large additional investments that are being channelised to this effort, Bharat Nirman will impart a sense of urgency to these goals by making the programme time-bound, transparent and accountable. Bank of India may like to study how they can participate in the Bharat Nirman Programme. These integrated investments in rural infrastructure will unlock the growth potential of rural India and provide Urban Amenities in Rural Areas (PURA).

The Mission of PURA

One of the important components of national development is the creation of PURAs (Providing Urban Amenities in Rural Areas). PURA envisages integrated connectivities to bring prosperity to rural India. These are - physical connectivity of the village clusters through quality roads and transport; electronic connectivity through tele-communication with high bandwidth fiber optic cables reaching the rural areas from urban cities and through internet kiosks; and knowledge connectivity through education, vocational training for farmers, artisans and craftsmen and entrepreneurship programmes. These three connectives will lead to economic connectivity through starting of enterprises with the help of banks, micro credits and marketing of the products.

Each PURA cluster will connect about 20-30 villages depending upon the region and population and will cost about Rs.100 crores. After initial short-term employment during construction etc., we have to plan for initiating actions for providing regular employment and self employment opportunities in nationally and internationally competitive enterprises in agro processing, manufacturing and services sectors for about 3,000 people. If the industrial/business parks are marketed well, they can generate employment opportunities in support sector for about 10,000 people for a village complex having 30,000 people. This will provide sustainable economy for the rural sector. Through an integrated development of the village cluster as a PURA complex, overall prosperity of the villages can be realized at half the cost and half the time required for conventional rural development. The total number of PURAs for the whole country will be around 7,000.

As I discussed with you Mr. Chairman and your team, already India has different models of PURA: one at Chitrakoot in Madhya Pradesh, second at Loni in Maharashtra, third at Bheemavaram in Andhra Pradesh, fourth at Vallam in Tamil Nadu and fifth at Gandhigram in Tamil Nadu. For all the five PURA?s leadership has emanated from either educational institution as focus or a medical foundation or research institution or an IT industry. I am delighted to hear that Bank of India is also planning development of 128 villages as Bank of India - PURA clusters. During our discussion, it came out that PURA has to uniquely focus on employment generation and around that many other connectivities and complexes have to be built.

The other important rural mission is the Rural Employment Guarantee Scheme for 200 districts of the nation, which ensures the availability of adequate funding support for Rural Development Missions and the increase of bank credit for agriculture to Rs. 1,75,000 crore during 2006-07. Very rarely the nation had such important commitments particularly for the rural development. Bank of India with its large experience in rural banking, must be able to provide vital banking support for these programmes.

While we discussed the mission of major rural economic transformation, I have come across various difficulties faced by the rural citizens in making bank as its partners. This distance is being created because of certain managerial directions to the banking industry, which is generally inflexible for the users. There are many unique experiences which I would like to share with you, so that the rural transformers of Bank of India with the unique quality of asking "what I can do for you" can benefit and apply to different areas in the country. To do this, the person should ask himself what he should be remembered for. I would like to share three experiences which brings out how a common citizen in the society looks for certain help from the bank, how he benefits if it is facilitated and what changes are brought about in him?

Banking and small entrepreneur

I would like to share an incident which took place during 1980s. There was a Cobbler named Swami in Saidabad area of Hyderabad. He was a good cobbler mainly working on repair of footwear. He had certain inherent entrepreneurship qualities, but he didn?t have adequate finance to pursue a business. Accidentally, he met one of our scientists in Defence Research and Development Laboratory. The scientist introduced Shri Swami to the State Bank of India, Kanchanbagh Branch. Based on this introduction, the Kanchanbagh Branch Manager was prepared to encourage Shri Swami and gave him an account with certain financial limit, without any collateral. Shri Swami started his business by making Ladies Chappal. He had a special skill of procuring the raw material like leather, rubber, thread, adhesives and nails at the most competitive rates from different destination in India. Also, he could mobilize the services of ten or twelve skilled technicians who could make quality chappals. With this resource, he established Swagat Footwear Shop in Saidabad and started producing and marketing the ladies chappal. The price and quality of the chappal were so competitive that all the ladies living in Saidabad, Kanchanbagh, Santhosh Nagar, Lakshmi Nagar and the other neighbouring area started purchasing the Chappals from Swagat Footwear. Meanwhile, one of the scientists from DRDL taught Mr. Swami, how to maintain the account and calculate his monthly profit and loss which enabled him to present to the banker the financial status of Swagat Footwear. His consistently good financial performance enabled the bankers to increase his loan limit through which he could move over to mens? chappal, shoes and many other leather products. Today, Swami is carrying out a very reasonably sized business and meeting all the footwear needs of adults and children of middle class families in Saidabad and the neighbouring areas. Through his hard work and entrepreneurship, he had educated all his children, his elder son Anil Kumar is undergoing footwear training in Chennai. Sunil the second son is in the tenth class. Three of his daughters are married in good families. He has cleared his entire bank loan. This is an example of how the Cobbler can be converted as an entrepreneur through the intervention of a bank. There may be hundreds of disadvantaged people like Swami waiting for such support with skill and looking for kind hearted approach to reveal and enhance their entrepreneurship in the unorganized sector. This incident really brings out how an individual can be made to prosper if they are provided help and guidance in time. Not only the money, but the training and exposure to basics of entrepreneurship and business ethics are needed for a person to succeed. The Bank of India could locate the right people in time and provide them with both the finances and management. The next incident is unique and demonstrates how a bank can make a difference to the family in distress.

In the knowledge economy, most of the banks will have to bank not only with the finances, but with ideas, technologies and innovations. This was first realized by the World Bank, when it started funding large scale projects for developing knowledge which would then become a tradable investment for furthering the growth of the economy. The Bank of India and many other banks should attempt to create knowledge pool by funding many groups suo motto and making this knowledge available to the participants of the PURA Programme. Many of the challenges which are common to the PURA programmes irrespective of the location, span generation of pure drinking water, rain water harvesting, bio-fuel systems, scalable tele-medicine and tele-education services etc., have been thoroughly discussed throughout the country. The bank should become a nodal agency to stimulate a movement to find solutions and create the knowledge base. The return on investment on such an exercise would be an order of magnitude higher than mere returns from the loans and advances provided.

Bank can make the difference to the family.

During July 2004, I received a letter from Ms. Jaspreet Kaur, aged 22 years, D/o. Gurpal Singh of village Thakkarwal, Hoshiarpur District of Punjab. She has three sisters and a brother. All are in the school and college going age. Her father is a farmer with 2.5 hectare of land and she says they were not getting any revenue from the land. They were not able to sow cash crops because of the high initial expenditure involved in growing cash crops. Due to non-availability of funds they cannot own a tractor, sow tested good quality seeds and fertilizers.

In the letter to me, she brought out how a farmer with small holding neither can get the advantage of large farm practices nor he can work in the farm and create his own wealth, since he is not used to working in the farm with his hands. In her case, her father owned earlier 5 hectares of land and part of it was sold to repay the family debt and she claims that the family was continuously in a debt trap. At the time of writing the letter, the family had a debt of Rs. 2 lakhs borrowed from Primary Agriculture and Land Development Bank, Mahilpur and the bank employees were giving them trouble by going to their house and insulting them. In addition, the family was having a court case in the High Court for the last 34 years which could be decided in their favour if fought properly by the lawyer. The lawyer was demanding Rs. 10,000 for the appearance.

I discussed this matter with Shri S.S.Kohli, the then Chairman and Managing Director, Punjab National Bank and requested him to help the family. Shri Kohli intervened personally and sent a lady officer to understand and provide assistance. Through this beautiful gesture he got the loan drawn from Primary Agriculture Land Development Bank, Mahilpur regularized and he also resolved the family dispute between her father and her grand father Shri Saran Singh who agreed to provide the share of land to Shri Gurupal Singh. These two actions resulted in improving the total economic condition of the family leading to a stress free better quality life for all the family members. Ms. Jaspreet Kaur is extremely happy with the help rendered by the Punjab National Bank and the children are pursuing their studies in peace without continuous humiliation and stress. This is a typical predicament of a small and marginal holding farmer in our rural areas. Intervention of banks and financial institutions is needed to uplift these farmers with appropriate financial and technological input so that they can lead a quality life in our villages. The Abhay scheme introduced by Bank of India as a part of its centenary celebrations for offering credit counseling and rehabilitation services to underprivileged farmers is a welcome move in this direction.

In a developing country like India where many of the rural population would often require a financial help with a heart of a mentor. Very often these two roles are played by two different agencies, if the bank could combine these two roles and carry on the traditions set by Mr. S.S. Kohli, we will not have any defaulters of loans, nor failures but mostly successful and prosperous rural population living in harmony of a family life.

Employment seeker to generator

In 2001, Dr. S.A.H. Abidi, was serving as a Member, of the Agricultural Scientists Recruitment Board, New Delhi. One day he was approached by a graduate from village Salempur, from Eastern Uttar Pradesh asking for a peon?s job or any menial job in Delhi to enable him to feed 6 dependents including his old parents. Dr. Abidi gave a patient and sympathetic hearing and came to know that he had a piece of land in his village through which he is not able to make proper livelihood. He asked him, whether he would like to work in his own village if he gets an opportunity to improve the land and cultivate. He agreed but he needed banking finance as well as a technology. Dr. Abidi arranged the training for the boy at Vegetable Research Institute Varanasi (ICAR). The boy went to Varanasi and received the training in vegetable cultivation technique. After the training, he went to his village Salempur and started cultivating vegetable in his farm with the bank loan of Rs. 50,000/- provided by State Bank of India, Shahganj branch. He packed the vegetables in old newspaper bags and carried himself to Shahganj market. He is now earning on an average over one lakh per year through his farm operation by staying in the village itself. He has also repaid the loan amount in two years through installments. He is one of the happy young men taking care of his family. Now, if we provide him further technology of agro-processing, he will able to make larger revenue and provide employment to many youth in the region.

This is the story, how a graduate has not been wasted and has become a good agriculturist working for the rural prosperity in his own village.

Identifying proper opportunities that may be available locally is also another important ingredient for success of an individual and the society. Banks could use outreach programmes to stay in touch with the local population, particularly educated unemployed and women to constantly work towards improving the economic conditions of the locality. In short, the banker must become the traditional village postmaster or the village school master.

All these three incidences which I have referred, bring out how the bank can not only be a source of funds, but a fountain of knowledge, a river of humane affection, and the most trust worthy member of the family all rolled into one. Bank of India with a history of hundred years definitely would have touched thousands of hearts and made a change, either individual, family or the village itself. On the occasion of Centenary Celebrations of Bank of India, you may like to take up a project titled "enriching human lives".

Today, the banking industry has become synonymous with Information and Communication Technology. Banks in India are fairly advanced in this movement. Technology is not always very friendly towards rural population because of what is known as digital divide. The banks could also use the same technology to overcome this digital divide and bring about inclusive banking.

In order to celebrate the centenary of the banking in a most befitting way, the Bank of India should bring out a volume that should describe its contributions to banking with a heart.

The bank should also launch several missions of local relevance such as improving the educational and medical infrastructure in their locality and participate in other welfare and employment generation schemes.

In the changing scenario of a knowledge economy, we have paradigm which is, "companies that make more and more software free, capitalize more". This simply means that shorterm benefits and interest based loans may not be the best way. Creating and trading knowledge, loaning money and best management practices and working with a heart by the bank may produce an order of magnitude higher return on investments in times to come. This can even afford to have a few failures, because one success will cover the losses of many failures. In order to carry out such banking practices through which the nation?s prosperity can be assured, we need to create a new framework of rules for development banking.

Conclusion: Missions for Bank of India

While concluding, I would suggest the following six missions for the consideration of Bank of India.

a. Dynamics of Villagers loan: I have seen myself, how villagers borrow money from 'B' to payback the loan taken from 'A'. Next stage they barrow money at a higher interest from 'C' to pay back 'A' and 'B'. Such burden of cycle of loan creates many societal problems. Recently in one of the states, people with money go to each house and give loan at high interest rates, after deducting the interest. You are experts and you have a social responsibility. I would like you to introduce a villager friendly banking system which will free the villagers from cycles of loans.

b. The value addition is very important for agriculture sector, so food processing and marketing are very important. Banking sector can assist in starting the food processing parks. This will help the agriculture sector to contribute to the target of minimum 4% growth in GDP.

c. Increasing the agriculture and agro processing credit to 25% from the present 19% of the total loan disbursal within the next two years with visible enhanced productivity. This will include advances for setting up of PURA complexes and small enterprises in PURA clusters.

d. Creating and nurturing ten rural development projects similar to bio-fuel project, seaweed project, Madhubani painting, what Bank of India is already doing in Bihar which may be applicable for large number of villages leading to employment generation through enterprises for at least one million rural youth.

e. Participate in infrastructural development including provision of 10 million energy and water efficient quality houses with basic infrastructure in the rural areas in association with state and central urban development authorities.

f. In the present economic situation, it is essential the venture capital business has to increase in magnitude, particularly with hassle free procedures. I have come across a European experience of a physics graduate turning into 100 million dollar exclusive venture capital banker and leading to establishment of a 10 billion dollar company. The chief executive of that company met me sometime back. In this context the Bank of India may also consider entering into venture capital business.

Leave behind a monument or legacy so that many generations will remember with pride the Bank of India for its 100 years of service. May I once again greet all the members of the Bank of India community during its Centenary Celebrations. My best wishes to all the members of the bank success in their mission and a very illustrious second century on the path followed by the great founders.

May God bless you.

<<Back

|

|