|

|

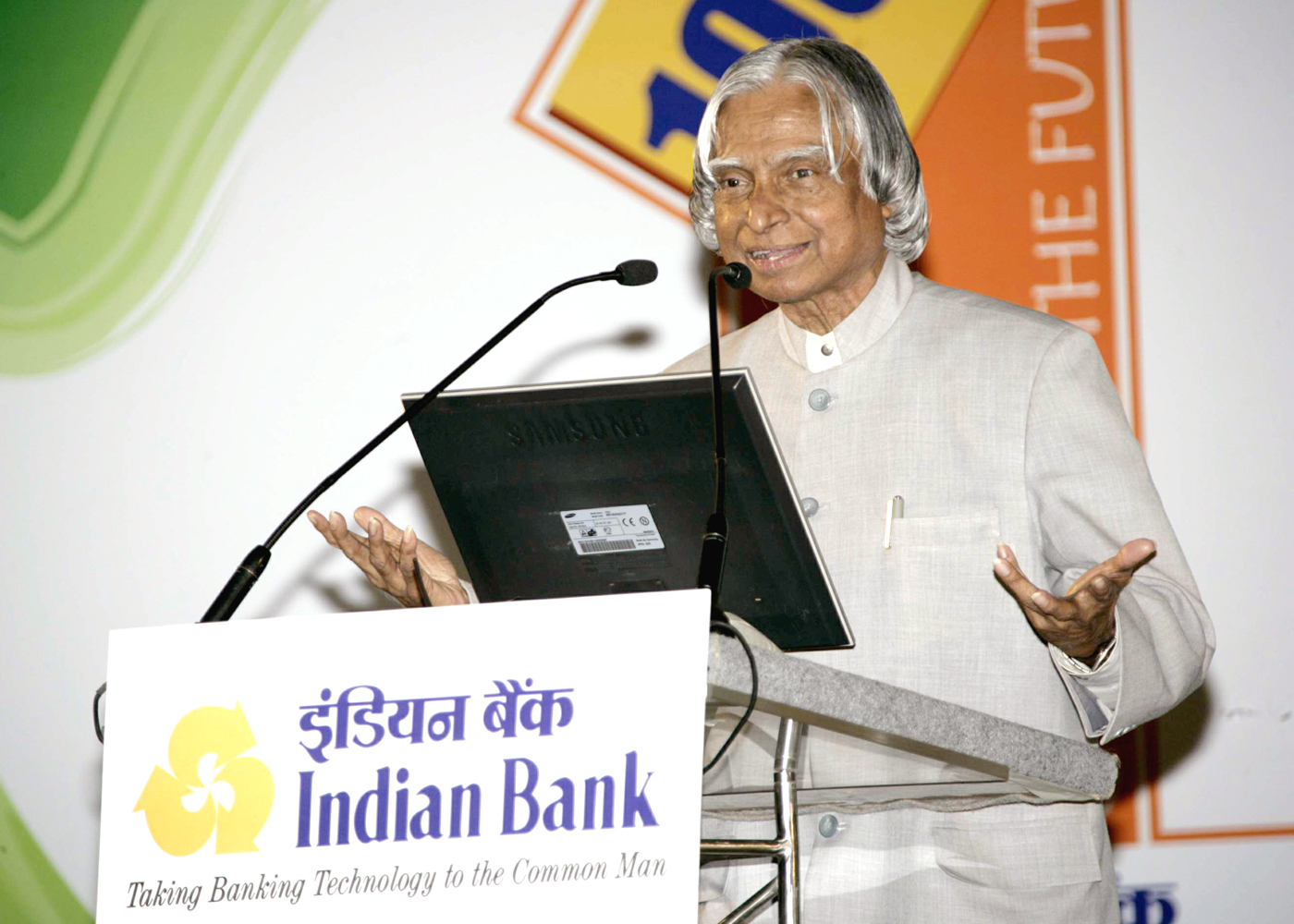

ADDRESS AT THE INAUGURATION OF THE CENTENARY CELEBRATIONS OF INDIAN BANK,CHENNAI

04-09-2006 : Chennai

Banking for Rural Prosperity

I am delighted to participate in the Centenary Celebrations of Indian Bank. Indian Bank during the last hundred years has been a partner of the Government and people in every economic activity. I congratulate the Indian Bank community both present and past, who have built a robust institutional framework for banking during the last hundred years. I extend my greetings to the organizers, senior bankers, economists, policy makers, academicians, government functionaries and all the bank employees, particularly young executives, who will carry the bank into the coming decades. I was thinking what thoughts I can share with you today. Historically, I find that the Indian Bank started as a Swadeshi bank with a deposit of Rs. 2 lakhs with one branch on 15th August 1907, exactly four decades before our independence. Today, the deposit with the bank has grown to over Rs. 40,000 Cr. in over 1400 branches. I am happy to know that the loan disbursal to the agriculture sector has been doubled by Indian Bank in the last two years which is definitely creditable. This pace should be kept up and the bank must have a target of increasing the support to at least 50 lakh farmers within the next three years. I am also happy that the bank is making good progress in core banking solutions and rural internet kiosk centres. I have selected the topic for discussion "Banking for Rural Prosperity".

Nurturing Self-help Groups

When I think of Indian Bank, I am reminded of my visit to the exhibition of handicrafts products made by self-help groups financed by Indian Bank on 16th September 2001 at Chennai. The concept of self-help groups particularly for the rural development is very important. Through this initiative of Indian Bank, they had enabled 5000 self-help groups involving a population of one lakh and disbursed credit to an extent of Rs. 67 Cr. I remember, Smt Ranjana Kumar, the then Chairperson of Indian Bank introducing me to the members of the self-help group who were exuding the pride of success in such a mission. I purchased a hand made "kolusu" for my grand daughter in that exhibition.

The purpose of that exhibition with 75 stalls was to exhibit the produce of the self-help group members to promote technology consciousness and marketing of products. It was a unique experience to find that the exhibition attracted many buyers for the SHG products and within three days Rs. 4 lakhs worth products were sold. I understand that this phenomena continued and exhibitions have now become a standard promotion media for Self-Help Group products. I am happy to know that during the current year, Rs. 392 Cr. have been disbursed as credit assistance to 53,285 self-help groups which represents an order of magnitude increase over the years. I would suggest that this trend be continued with consistent quality bench marks which are essential for the economic development of the rural areas particularly through the empowerment of women. Here, I would like to mention the handicraft promotion work taking place at Chhindwara and Seoni in Madhya Pradesh, as a collaborative venture of the State Government, Central Government and JETRO of Japan. The feedback on prototypes in exhibition in Japan is used to further improve the product for global marketing. Indian bank may like to consider similar model for encouraging self-help groups to take up production of quality products for sale in the international markets.

Great Leadership experience from Indian Bank

The experience how Indian Bank succeeded recovering from difficult time is indeed an experience not only for Indian Bank but for the banking system in the country. At this point, I would like to recall the discussion I had with the former Chairperson of Indian Bank, Smt Ranjana Kumar who gave me her experience in transforming Indian Bank to its present status. She remembers with a sense of pride, warmth and gratitude the team work of the entire Indian Bank family in making this turn around possible. I am happy to learn from the present CMD Dr. K.C. Chakrabarty, that the bank is making continuous progress and the highest ever dividend payment has been made to the Government by Indian Bank last year. I would like to congratulate all of you.

Indian bank radiates confidence of management

Following are the some of the noteworthy interventions made for the revival process:-

a. Utilizing the existing manpower and retraining them to get the desired objectives of revival without resorting to change of manpower.

b. Promoting an effective communication methodology between the top management to all the functionaries of the bank up to the grassroots level.

c. Making the total Indian Bank team as partners in the revival process through mutual trust and confidence and a transparent system of decision making.

d. Progressively increasing the level of delegation and transforming a centralized organization into an effective decentralized profit centres.

e. Working on the strengths.

f. Acknowledging the contribution and the sacrifices made by the team members during the reengineering process.

g. Realizing the importance of nurturing people at all levels through intensive tailor made training programmes.

h. Reviving customer confidence.

I would now like to discuss some of the opportunities for Indian Bank in effecting rural transformation towards national development.

Rural transformation through PURA

As you all are aware, the nation has a vision of transforming itself into a developed country by 2020. This involves improvement of the quality of life of one billion plus people particularly the 220 million people who are presently living below poverty line. Another aspect, which we have to take into account, is the need for improving the quality of life of 70% of population who are living in rural areas. Indian Bank with its mission of being a common man?s bank is well equipped to spread its wings into the rural sector. As you all are aware, it is proposed to establish 7000 PURAs (Providing Urban Amenities in Rural Areas) throughout the country to bring rural prosperity. PURA envisages physical connectivity, electronic connectivity, knowledge connectivity thereby creating economic connectivity in the cluster of villages forming the PURA. Indian Bank with its rural base can contribute to the establishment of PURAs. Let me explain.

Indian Bank can consider creation of two types of PURAs namely Coastal PURA in coastal area and plain PURA in other regions. In the coastal PURAs the focus can be on fishing, fish processing, support systems for fishing industry, seaweed cultivation and bio-fertilizers. In the plain PURA, using the core competence of the region such as creation of Jatropha enterprises where the possibility of irrigation facilities are limited and agro-processing enterprises where agriculture and horticulture are dominant. Indian Bank with its experience in Union Territory of Pondichery and Cuddalore District can take up a lead role in creating PURA complexes in partnership with societal organizations, industry and educational institutions.

Bio-products from Seaweed: Coastal PURA Employment Generator

Scientists of Central Salt and Marine Chemicals Research Institute (CSMCRI), Bhavnagar have developed an important thickening agent Car-ra-gee-nan using seaweed called Kap-pa-phy-cus al-va-re-zii that bestows useful properties to many commercial products such as toothpaste, ice-cream, pet food and soft capsules. Women self-help groups in Mandapam region of Tamil Nadu are engaged in the cultivation seaweed with the help of certain financial institutions.

Technology is available for liquefying the seaweed which can be separated into a solid and a liquid to obtain two products. The solid is the source of car-ra-gee-nan and the liquid is a plant nutrient. This sap has been used in a variety of crops such as sugarcane, paddy, maize, pulses and several fruits and vegetables. The productivity increase has been in the range of 20% to 40% in different regions for different plant varieties as per studies conducted by regional institutions.

I would suggest seaweed cultivation and value addition should be taken up as a mission mode project of fishermen co-operatives and self-help groups of the coastal areas, particularly in the PURA complexes in partnership with scientists, industrialists and Indian Bank.

The next area I would like to suggest is the large scale participation of Indian Bank in the small and medium scale industries as part of PURA complexes.

Jatropha ? Biofuel

Government has decided to permit mixing of 10% bio-fuel with diesel. This has opened up new opportunities for employment and wealth generation. Farmers have started cultivating Jatropha in many areas in the country in wasteland. But they have certain problems such as low productivity, non-availability of standardized good seeds, technical advice, non-availability of information about oil extraction and esterification equipments and lack of knowledge about prospective purchasers of Jatropha seed or Bio-fuel. To enable the farmers to work without interruption, there is a need to take a comprehensive view of the total chain from Jatropha plantation to efficient extraction, esterification and marketing. While these issues are being taken up, the research and development personnel, entrepreneurs and financial institutions like Indian Bank have to hold the hands of the farmers by way of financing the agricultural process, the research, establishment, operation and maintenance of the industries till the whole process becomes self-sustainable. I understand that the Government of Tamil Nadu has decided to plant Jatropha in over one lakh hectares of land and create over 200 processing centers within the next five years. I would suggest Indian Bank to become an active partner in timely realization of this mission.

Agro-processing

Tamil Nadu is rich in agricultural produce and horticulture produce. This produce is largely being marketed as raw material. There is a scope for converting this into food products and marketed as ready to eat food in the national and international market where there is a great demand. Tamil Nadu has necessary skill and competence in making ready-to-eat food in the state. The Central Food Technology Research Institute (CFTRI), Defence Food Research Lab (DFRL) and the private sector industries can provide the latest technology input for converting the agro and horticulture products into ready to eat food. With this strength Tamil Nadu should become a leading destination for food processing. Recently, it has been reported that Indian Currypacks in 10 ltr. drums are in great demand in both US and UK. This will give an opportunity for the farmers in the unorganized sector to supply cut vegetables to the food service centers, if they maintain the quality and cost competitive. They also can supply processed meat, sea food, ready-to-use perishables, processed and semi-processed bakery products. What is needed is facilities for hygienic processing, rugged packaging and guaranteed quality including standardization of the product. Indian Bank can promote these food processing units as part of certain PURA complexes which have potential for producing vegetable, fruits and grains.

Missions for Indian Bank

I would suggest the following missions for the consideration of Indian Bank:

a. Increasing the branches from the existing 1400 to minimum 2000 within the next three years. Priority may be given to establishment of branches in the rural sector. Creation of five additional branches abroad may also be considered. Each branch has to have a unique business and sustainable societal objective based on the core competence of that region.

b. Creating and nurturing five rural development projects similar to bio-fuel project, sea weed project and agro food processing project which can be applicable for large number of villages leading to employment generation through enterprises of rural youth.

c. Creation of entrepreneurial development centres which will be able to support the creation of PURAs and also special PURA enterprises in partnership with Universities, Colleges and the Chambers of Commerce and Industries in the region.

d. The Indian Bank can consider provision of medical insurance to the unorganized sector on the lines of Yeshaswini model followed by Karnataka as an extension of the healthcare scheme being already provided by the Bank.

e. Dynamics of Villagers loan: I have seen myself, how villagers borrow money from "B" to payback the loan taken from "A". Next stage they borrow money at a higher interest rate from "C" to pay back "A" and "B". Such burden of cycle of loan creates many societal problems. Recently in one of the states, people with money have gone to each house and given loans at high interest rates, after deducting the interest. You are experts and you have a social responsibility. I would like you to introduce a villager friendly banking system which will free the villagers from such cycles of loans.

Conclusion

While concluding I would like to quote Mahatma Gandhi who had said "the difference between what we do and what we are capable of doing would suffice to solve most of World?s problems". This has been proved by the Indian Bank by rising to the occasion, facing challenges and coming out gloriously from difficult situation. This is definitely a model not only for the posterity of Indian Bank but also for every business establishment in the country. With your mission of being a lead banker of the country, you have to set higher targets for the next two decades for making larger contribution in the national development tasks. Indian Bank must be seen in every part of the country especially in rural India. You should be known for promoting business through enterprising youth who constitute 50 percent of our population.

All of you assembled here have an important role to play in the development process of the Bank through creative leadership. Who is that creative leader? What are the qualities of a creative leader? The creative leadership is exercising the task to change the traditional role from commander to coach, manager to mentor, from director to delegator and from one who demands respect to one who facilitates self-respect. Such leaders of the bank will facilitate the Indian Bank to become the top ranking bank of the country.

I greet all the members of the Indian Bank community during its Centenary Celebrations. My best wishes to the Indian Bank for success in all its missions.

May God bless you.

<<Back

|

|